I Owe the Banks a Lot of Money Manifestation: Break Free!

If you’re struggling with a large amount of debt owed to banks, manifestation can help you find a path to financial freedom. By focusing on positive thoughts and taking actionable steps, you can attract opportunities to improve your financial situation.

Understanding the power of manifestation in transforming your financial reality is the first step towards overcoming debt. This article will explore the concept of manifestation and provide practical tips for using it to address your financial challenges. Whether you’re facing overwhelming credit card debt, loans, or other financial obligations, harnessing the power of manifestation can lead to a more secure financial future.

The Burden Of Debt

The burden of debt can have a significant emotional toll on individuals. It creates a vicious cycle that can be difficult to break free from. The constant stress and anxiety associated with owing a large amount of money to banks can take a toll on a person’s mental well-being.

The feeling of being trapped in a cycle of debt can lead to feelings of hopelessness and despair. It can affect relationships, self-esteem, and overall quality of life. The weight of the financial burden can be overwhelming and cause individuals to feel like they are drowning in their financial obligations.

Breaking free from this cycle requires careful planning and taking proactive steps towards financial freedom. It may involve seeking professional help, creating a budget, and making necessary lifestyle changes. By taking control of their finances and working towards debt repayment, individuals can begin to alleviate the emotional toll that owing money has on their lives.

Manifestation Principles

Manifestation principles are based on the law of attraction basics, which is the idea that what we focus on and believe in will come into our reality. This includes our mindset and money. If we have a negative mindset about money and believe we will always be in debt, then that is what we will attract. However, by changing our mindset and focusing on abundance and financial success, we can manifest the money we need to pay off our debts.

One way to shift our mindset is through affirmations and visualization. By repeating positive affirmations such as “I am financially abundant” and visualizing ourselves being debt-free, we can train our subconscious mind to believe in our financial success. Additionally, taking action towards our financial goals, such as creating a budget and paying off debts, can further reinforce this positive mindset.

Debt And Manifestation

Manifesting debt freedom is a powerful tool to attract financial abundance. By aligning beliefs with financial goals, one can begin to shift their mindset towards prosperity. Visualizing a debt-free future helps in creating a positive and abundant mindset. Embracing the belief that it is possible to achieve financial freedom can lead to taking inspired action towards that goal. It’s important to focus on the feelings of freedom and relief that come with being debt-free, as this can help in manifesting the desired outcome. By consistently practicing manifestation techniques and staying committed to the vision of debt freedom, individuals can attract the resources and opportunities needed to improve their financial situation.

Actionable Manifestation Steps

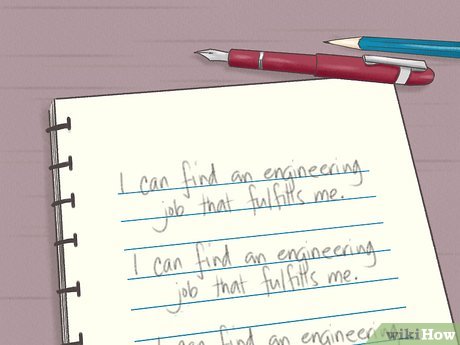

Manifesting abundance in your life is a powerful way to attract financial prosperity. By taking consistent action and incorporating daily affirmations, you can shift your mindset and attract more money into your life. Here are some actionable steps to help you manifest abundance:

- Set clear intentions: Clearly define your financial goals and visualize them as already achieved.

- Create daily affirmations: Repeat positive affirmations such as “I am abundant” and “Money flows easily to me” to reprogram your subconscious mind.

- Practice gratitude: Express gratitude for the money you currently have and for the abundance that is coming your way.

- Create a vision board: Gather images and words that represent your financial goals and create a visual representation of your desires.

- Take inspired action: Take steps towards your goals, whether it’s saving, investing, or starting a side hustle.

- Stay focused and believe: Trust in the process and believe that you deserve financial abundance.

By following these actionable steps and incorporating daily affirmations, you can manifest the financial abundance you desire. Stay committed and open to the opportunities that come your way, and watch as your relationship with money transforms.

Practical Financial Strategies

Budgeting for Debt Repayment:

| Step 1: | Make a list of all your debts, including the amount owed, interest rate, and minimum monthly payment. |

| Step 2: | Review your expenses and identify areas where you can cut back. |

| Step 3: | Set a realistic monthly budget and allocate extra funds towards debt repayment. |

Negotiating with Creditors:

- Call your creditors and explain your financial situation.

- Ask if they offer any hardship programs or debt settlement options.

- Be prepared to negotiate and offer a lump sum payment or a lower interest rate.

- Get any agreements in writing and make sure you can afford the terms.

Mindfulness And Spending Habits

I Owe the Banks a Lot of Money ManifestationMindfulness plays a crucial role in shaping our spending habits. By practicing conscious spending, we can break free from impulsive buying patterns and gain control over our finances.

Conscious spending entails being fully present and aware of our purchasing decisions. It involves taking a moment to reflect on whether a purchase aligns with our values and long-term goals. By embracing this mindset, we can avoid mindless shopping and unnecessary debt.

One effective strategy is to pause before making a purchase and ask ourselves if it is a true necessity or merely a desire. This simple act of reflection can help us differentiate between our needs and wants, guiding us towards more intentional spending.

Additionally, tracking our expenses and creating a budget can provide us with a clear overview of our financial situation. It allows us to identify areas where we can cut back and save money, ultimately helping us pay off debts and achieve financial freedom.

Success Stories

| Success Stories |

| Testimonials of Overcoming Debt |

People who faced financial challenges share their journeys to financial freedom. They inspire others with their determination and perseverance. By learning from their experiences, we gain hope and motivation to tackle our own financial obstacles. These stories show that with hard work and focus, it’s possible to overcome debt and achieve financial stability.

Maintaining Financial Freedom

Achieving financial freedom is crucial for peace of mind. By manifesting a plan to repay bank debts, you can take control of your finances and work towards a debt-free future. Embracing financial responsibility brings stability and opens the doors to a more secure financial future.

| Maintaining Financial Freedom |

| Building an Emergency Fund |

| Prepare for unexpected expenses to avoid debt traps. |

| Long-Term Wealth Building Strategies |

| Invest in diverse portfolios for sustainable financial growth. |

Resources And Support

Discover the resources and support you need to manifest your way out of debt with “I Owe the Banks a Lot of Money Manifestation”. Access valuable tools, guidance, and expert advice to help you regain control of your finances and create a brighter future.

| Debt Support Groups | Financial Planning Tools |

| Connect with people facing similar challenges. | Tools to organize finances and create a repayment plan. |

Conclusion

In reality, manifesting financial abundance is not just wishful thinking, but a process that requires dedication and action. By understanding the power of manifestation and taking practical steps to improve your financial situation, you can gradually work towards paying off debts and achieving financial freedom.

Remember, manifesting abundance is a journey, not a quick fix.